Overtime pay calculator with taxes

The federal overtime provisions are contained in the Fair Labor Standards Act FLSA. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

Salary Calculator Singapore App Development App Development Companies Mobile App Development Companies

Dont forget that this is the minimum figure as laid.

. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. Unless exempt employees covered by the Act must receive overtime pay for hours.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The default value for overtime rate of the overtime pay calculator is 15 times. Get an accurate picture of the employees gross pay.

Overtime tax calculator Using. See where that hard-earned money goes - Federal Income Tax Social Security and. All Services Backed by Tax Guarantee.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. The simplest way to work out how much youll be taxed is to add. Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations.

Overtime pay calculator after taxes Selasa 13 September 2022 Edit. How do I calculate hourly rate. 1650 overtime rate of pay 5.

Your employer will withhold money from each of. Overtime pay of 15 5 hours 15 OT rate 11250. Tax you will pay PAYE Pay As You Earn for your age group and income bracket.

To calculate overtime rates use our Pay and Conditions Tool. First calculate Mollys regular wages. 1200 40 hours 30 regular rate of pay.

The employees total pay due including the overtime premium for the workweek can be calculated as follows. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. 30 x 15 45 overtime.

Overtime Hours per pay period. Tax withholding is the money that comes out of your paycheck in order to. Taxable income R 19980000 - R 000 - R 000.

11 hourly wage 15 overtime rate 1650 overtime rate of pay. Overtime Hourly Wage. Thats where our paycheck calculator comes in.

1200 40 hours 30 regular rate of pay 30 x 15 45 overtime. Wage for the day 120 11250 23250. See where that hard-earned money goes - with UK income tax National.

Taxable income for the year. Next divide this number from the. Next calculate Mollys overtime wages.

Regular pay of 15 8 hours 120. Our 2022 GS Pay. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. 2022 Philippines BIR TRAIN Withholding Tax calculator for employees.

Payroll Processing Services Haryana Payroll Legal Services Payroll Taxes

12 Free Time Sheet Templates Printable Word Excel Pdf Samples Timesheet Template Doctors Note Template Sign In Sheet Template

Pin On Tax Consulting

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Award Winning Cloud Based Hr Payroll Software In Singapore Video Payroll Software Hospitality Design Hrms

9 Ready To Use Salary Slip Excel Templates Exceldatapro Excel Templates Payroll Template Salary

Building Maintenance Checklist Templates 7 Free Docs Xlsx Pdf Maintenance Checklist Checklist Template Checklist

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

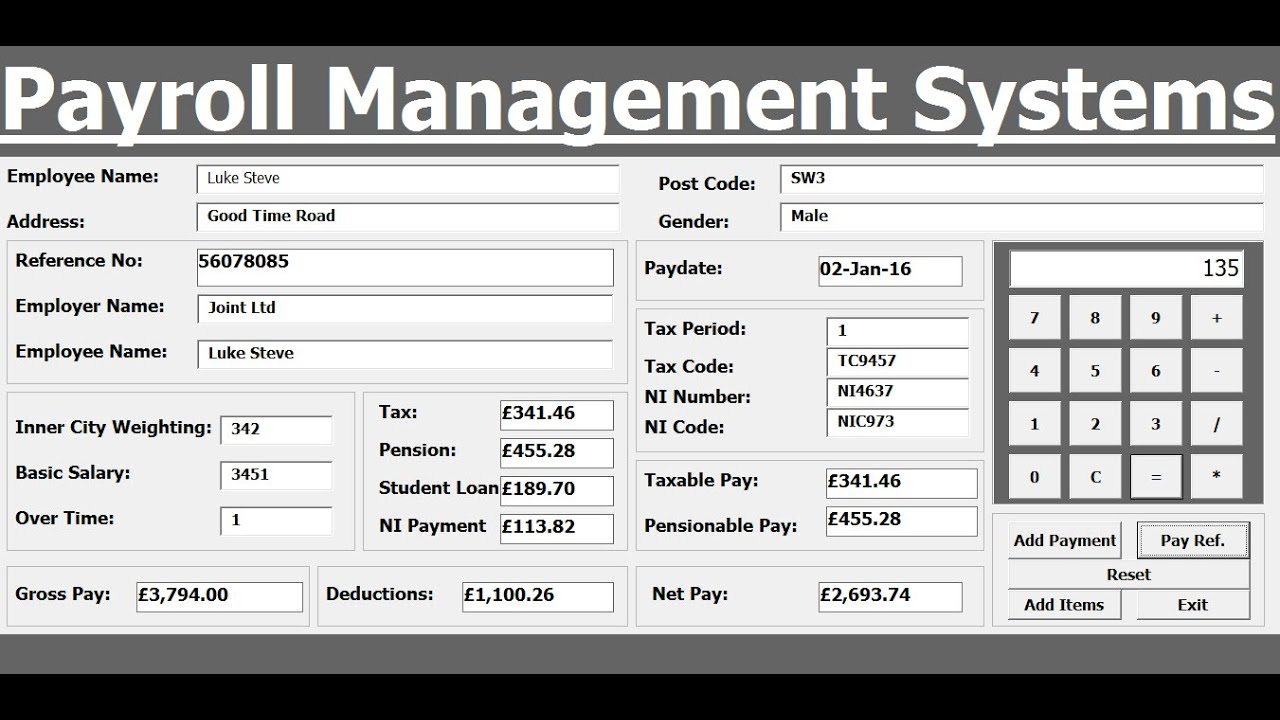

How To Create Payroll Management Systems In Excel Using Vba Youtube Payroll Management Excel

18 Cm Simply Make Another Mark To The Right Of The Run Line That Is Parallel And Equal To The Thickness O Naruzhnye Lestnicy Derevyannaya Lestnica Idei Dlya Doma

Calculating An Employee S Gross Pay Is Already Complex With The Numerous Factors To Consider Including The Number Of Hours Payroll Software Payroll Income Tax

Ms Excel Printable Payroll Calculator Template Excel Templates Payroll Template Excel Templates Payroll

Use This Template To Calculate And Record Your Employee Payroll Three Worksheets Are Included One For Employee Payroll Bookkeeping Templates Payroll Template

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Salary Calculator Template Google Docs Google Sheets Excel Apple Numbers Template Net Salary Calculator Salary Calculator

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template